O'Reilly Media

I led the team through a multi-phased platform redesign, starting with new global navigation. The new nav increased content consumption by an estimated 15%, improved customer satisfaction, reduced marketing spend, and improved sales enablement.

2022

Design Leadership, Information Architecture

Overview

One reason I was hired as the Product Design Director at O’Reilly was my ability to share a large-scale product vision for how I believed the learning platform could evolve. A major part of this vision involved overhauling the app's information architecture. While multiple teams provided valuable product briefs and insights, it was my responsibility to gain buy-in and ensure a successful outcome.

About O’Reilly

O’Reilly is an enterprise SaaS learning company with an estimated $160m ARR. Their online platform helps train millions of tech professionals from companies like Amazon, Netflix, and IBM. They offer exclusive live events, coding, certifications, books, videos, and more.

Problems

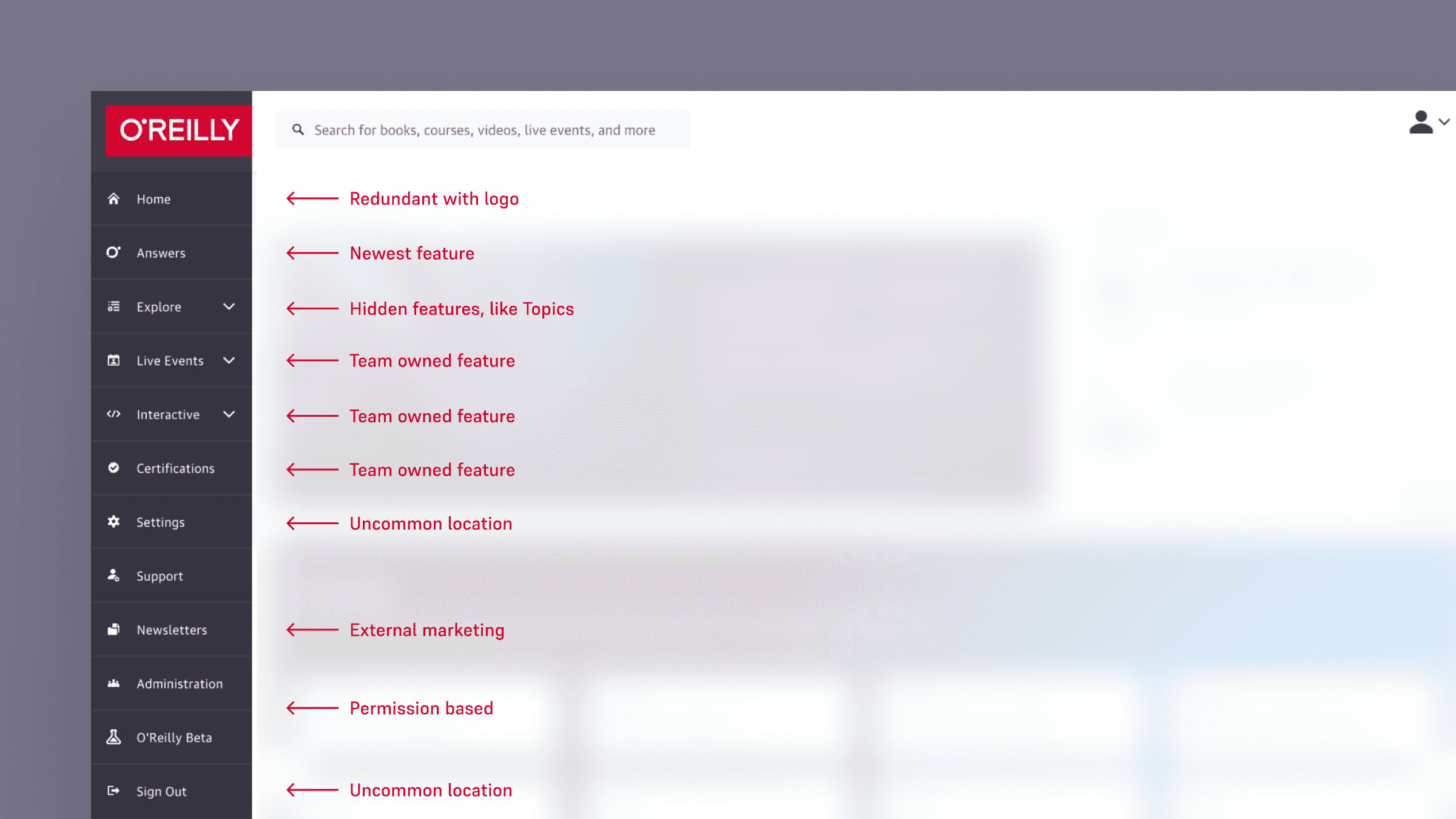

There were a number of known issues with the existing navigation, however, we faced three main problems:

The Choice Dilemma

Users of the platform encountered overwhelming choices on the app’s homepage and sidebar navigation. This ultimately reduced productivity and caused people to spend more time looking for content versus consuming it.

Modality-First

Content was mostly grouped by type (E.g., 'Live Events' or 'Interactive') versus topics that users were interested in. This led to a lot of noise which distracted from the user’s learning goals.

Promotion & Discovery

The existing navigation mirrored the org chart, with each product squad owning one or more sections. Each new feature often added another menu item, forcing users to constantly re-learn where to find their favorite features.

Analysis

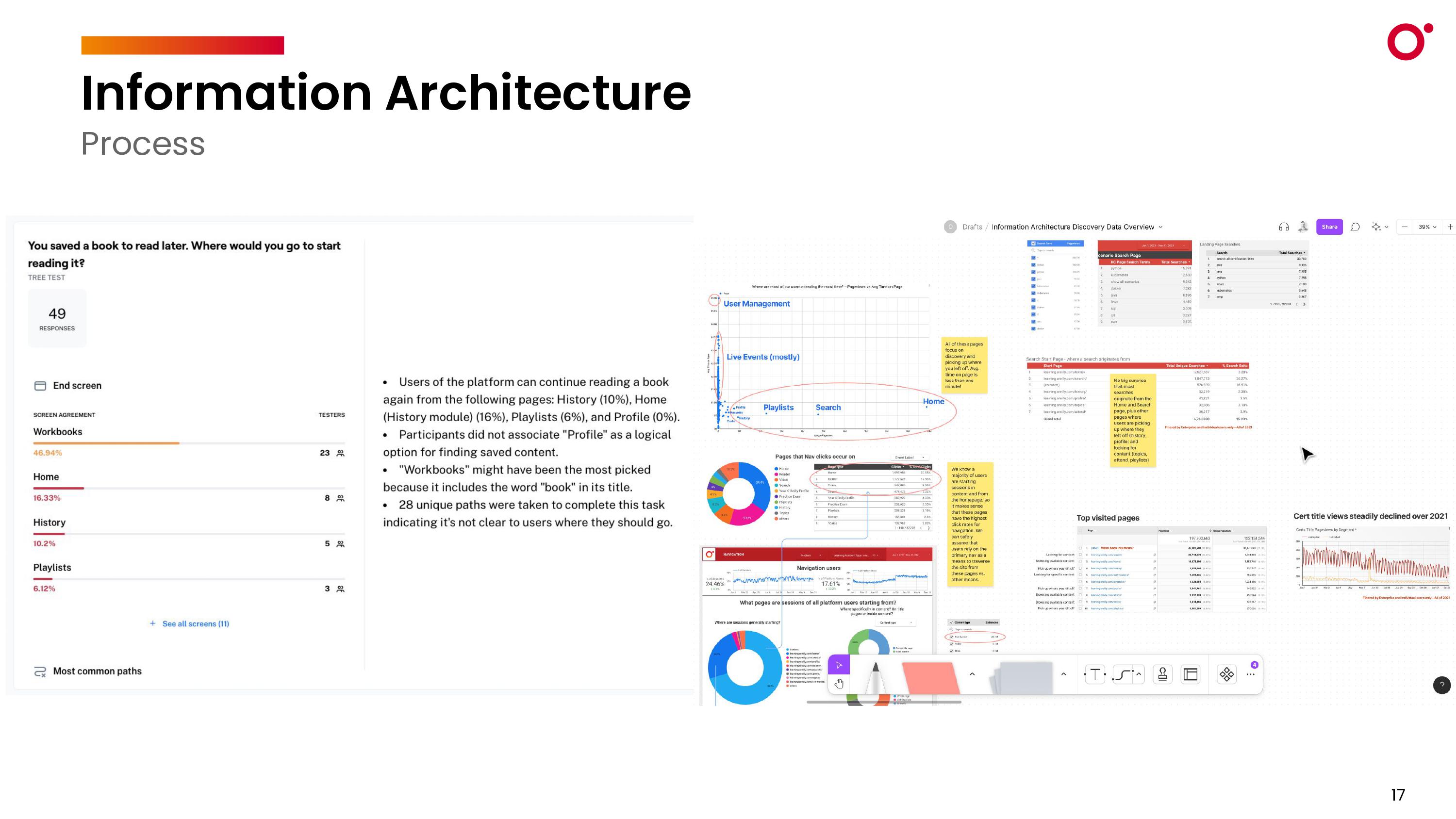

Data

Beyond landing on a homepage with nearly 143 options, the primary navigation adds 26 more options plus six more in the user profile menu. A clear example of Hick's Law—The more stimuli to choose from, the longer it takes to make a decision.

Rather than click through our lengthy navigation, users commonly default to using our platform search, where more than 20% of their queries are for broad topic areas, echoing their topic-first mental model.

When an event landing page was on the platform without marketing, we saw 86 registrations in the first week. When marketing was added, we had 770 registrations per week (795% lift over landing page).

“The amount of content for some topics is so overwhelming, that it would be good to have a ‘DJ’ that picks the beauties for a certain topic." —B2B User

The Customer Support team frequently comments that their administrators “don’t understand how to search” and need consistent hand holding through the discovery and curation process. Some sales reps also have created their own “cheat sheets” with popular topics and links directly to content to help arm themselves in sales conversations because it's not always easy or quick to find specific topics.

Goals and Principles

Objectives

Increase “Time to Value” for all subscribers (I.e., reduce time scanning content and increase time consuming it).

Increase awareness of new product features.

Attract potential investors by shifting perceptions from being a “content library” to a “true learning platform”.

What is the ideal user experience?

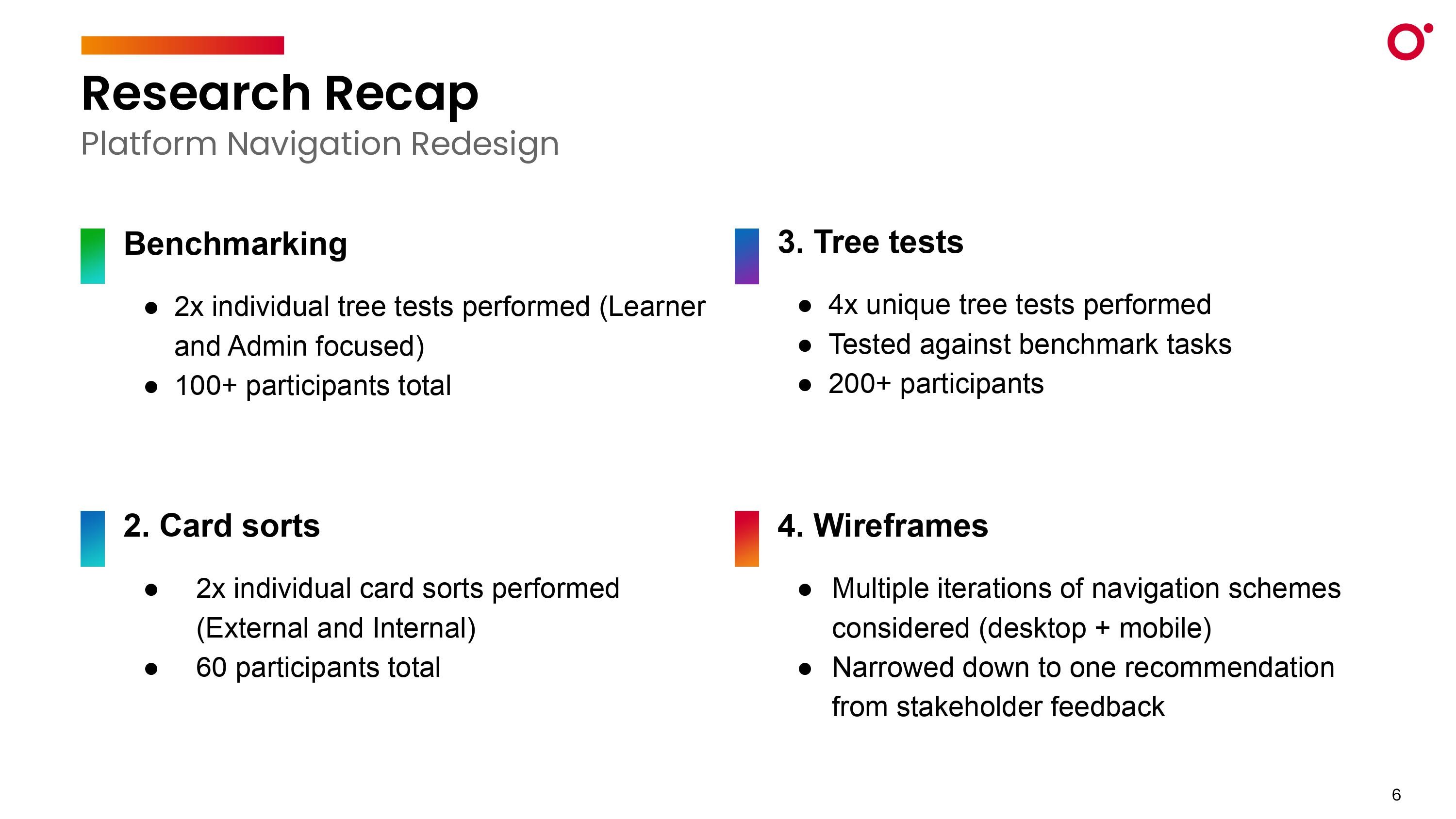

Research

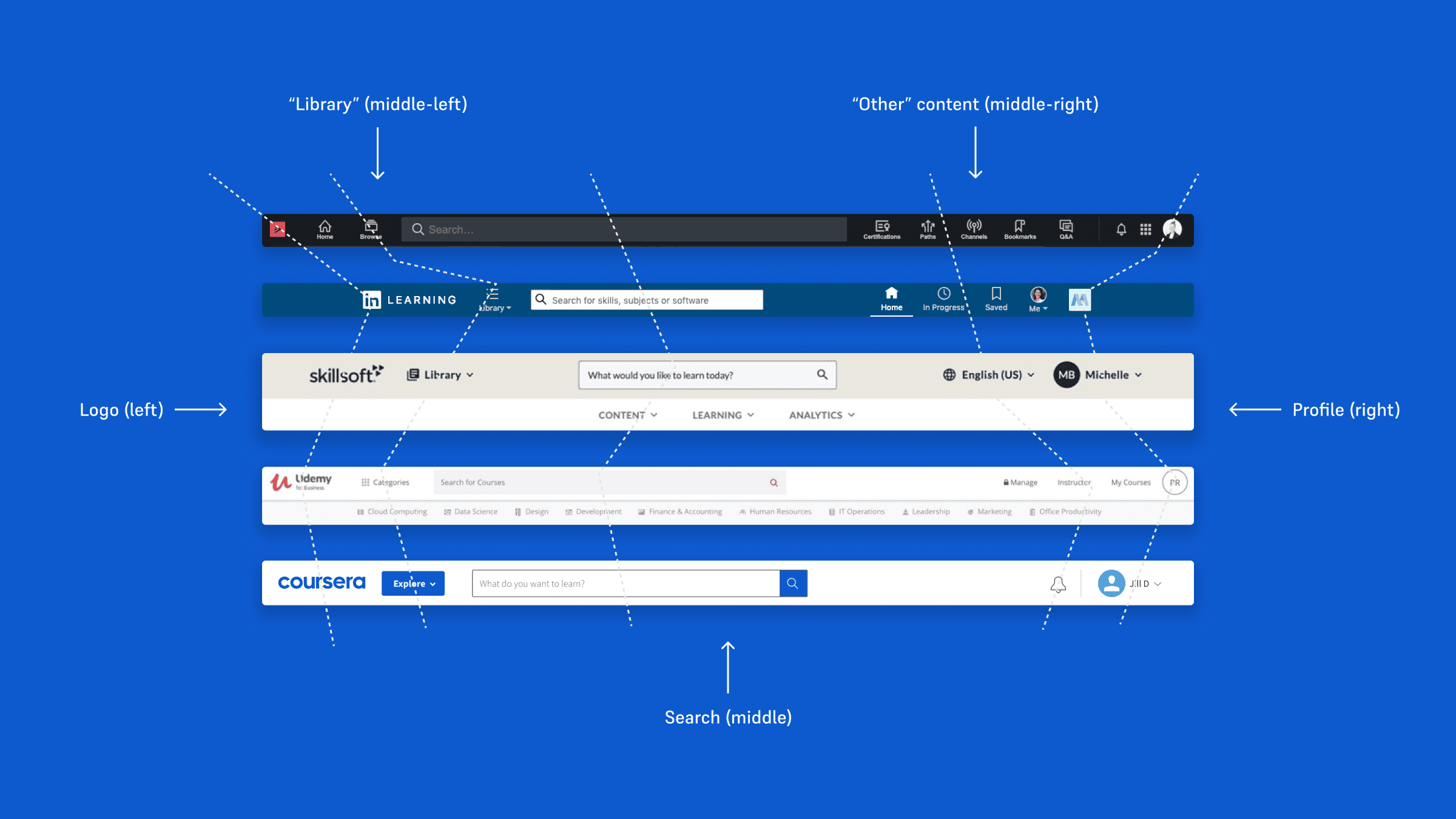

Differences in opinion

The Design team believed the navigation could be very simple, only including Topics, Search, and a user Profile. The assumption was that once a user found the topic they liked, they would discover all of the available content types related to that topic. However, leadership worried that hiding or removing popular nav items like Certifications, Playlists, and Live Events would result in decreased engagement. And the business wasn’t wrong in thinking this. Playlists were the most used feature on the platform, with Live Events generating the most revenue, and Certifications gaining rapid adoption. We needed to tread with caution.

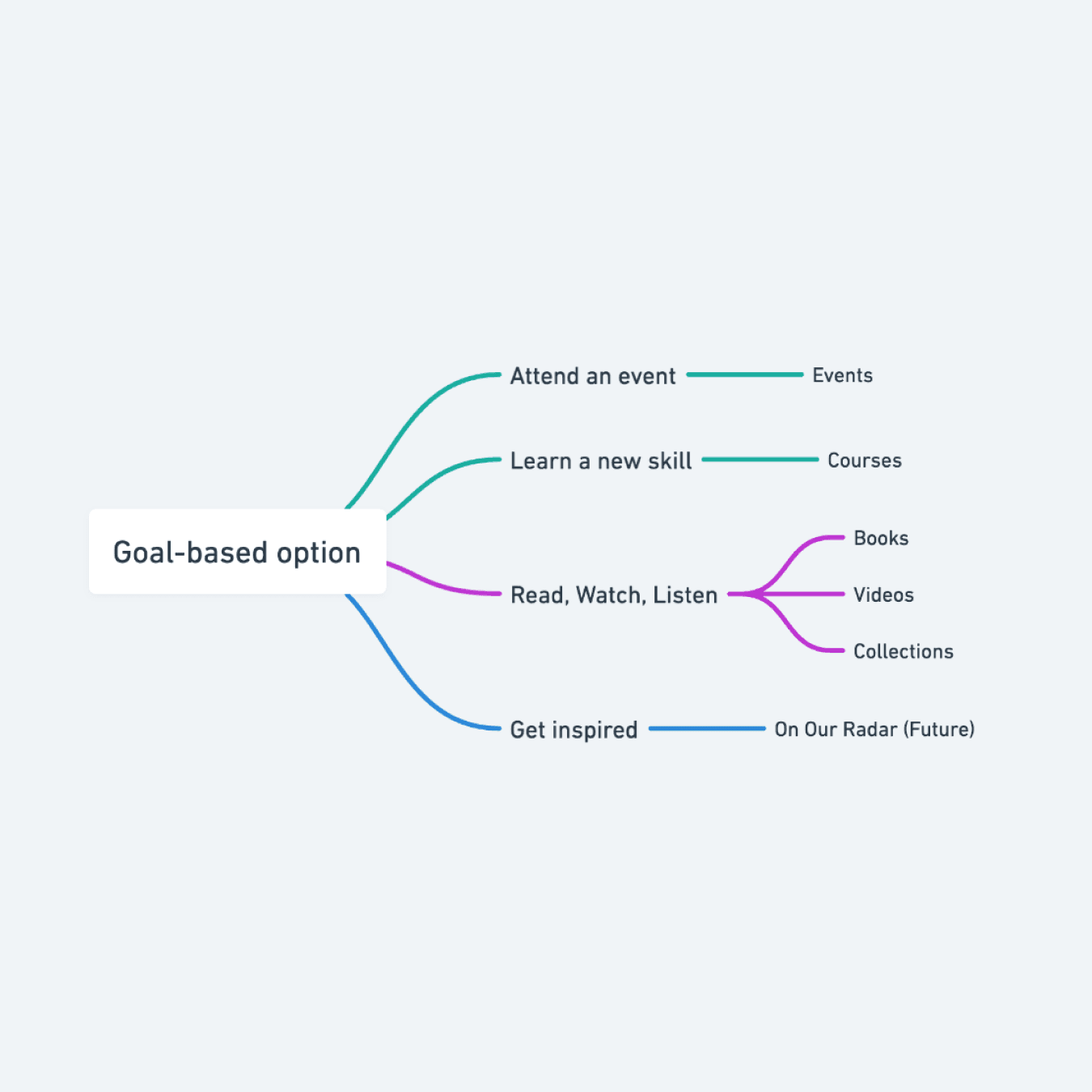

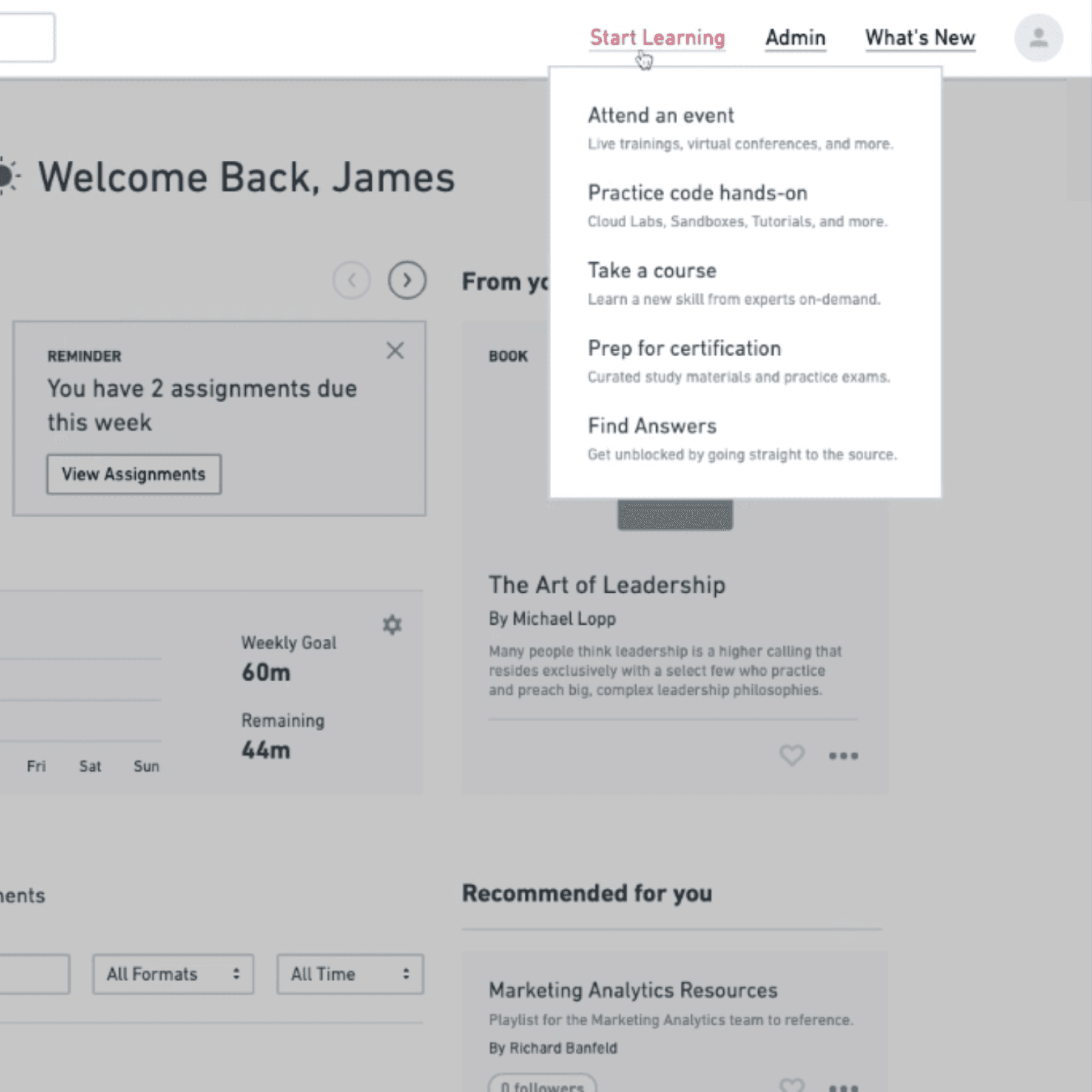

Solution

After some consideration, I introduced the concept of goal-based navigation. For example, “Learn a new skill” could lead you towards Courses, Videos, or Learning Paths, and then be filtered by topic. Through multiple iterations and feedback, this evolved into a single CTA, “Start Learning” with popular features grouped under it. This not only bridged the gap between topics and content types for our users, but it was also a good compromise between design and key stakeholders.

Action oriented

Not all users would want to narrow results by topic, so giving people a path to explore by their preferred learning style made sense.

Contextual

Adding a short descriptor below each menu item helped reduce the risk of accidental clicks, reducing frustration and increasing TTV.

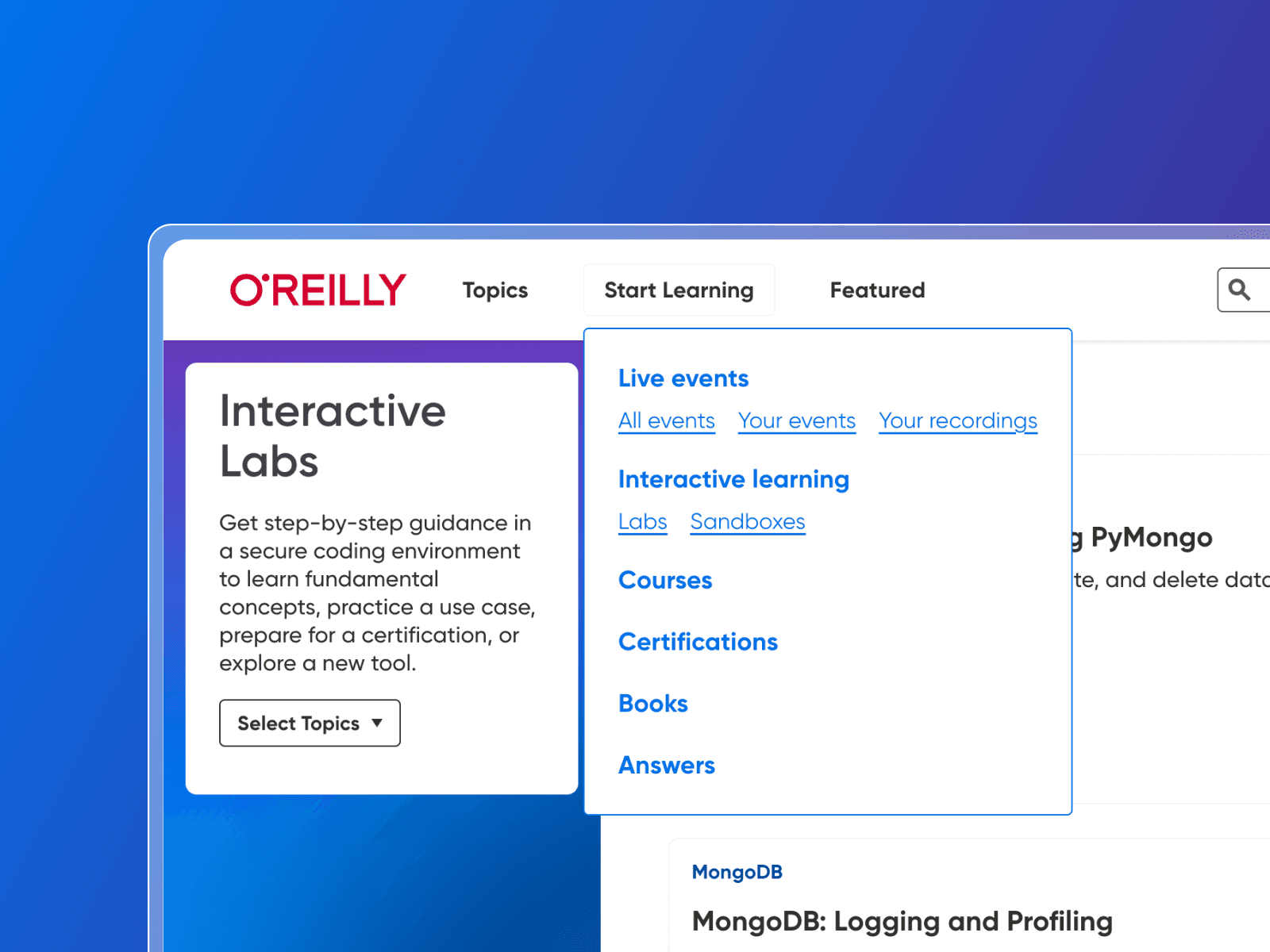

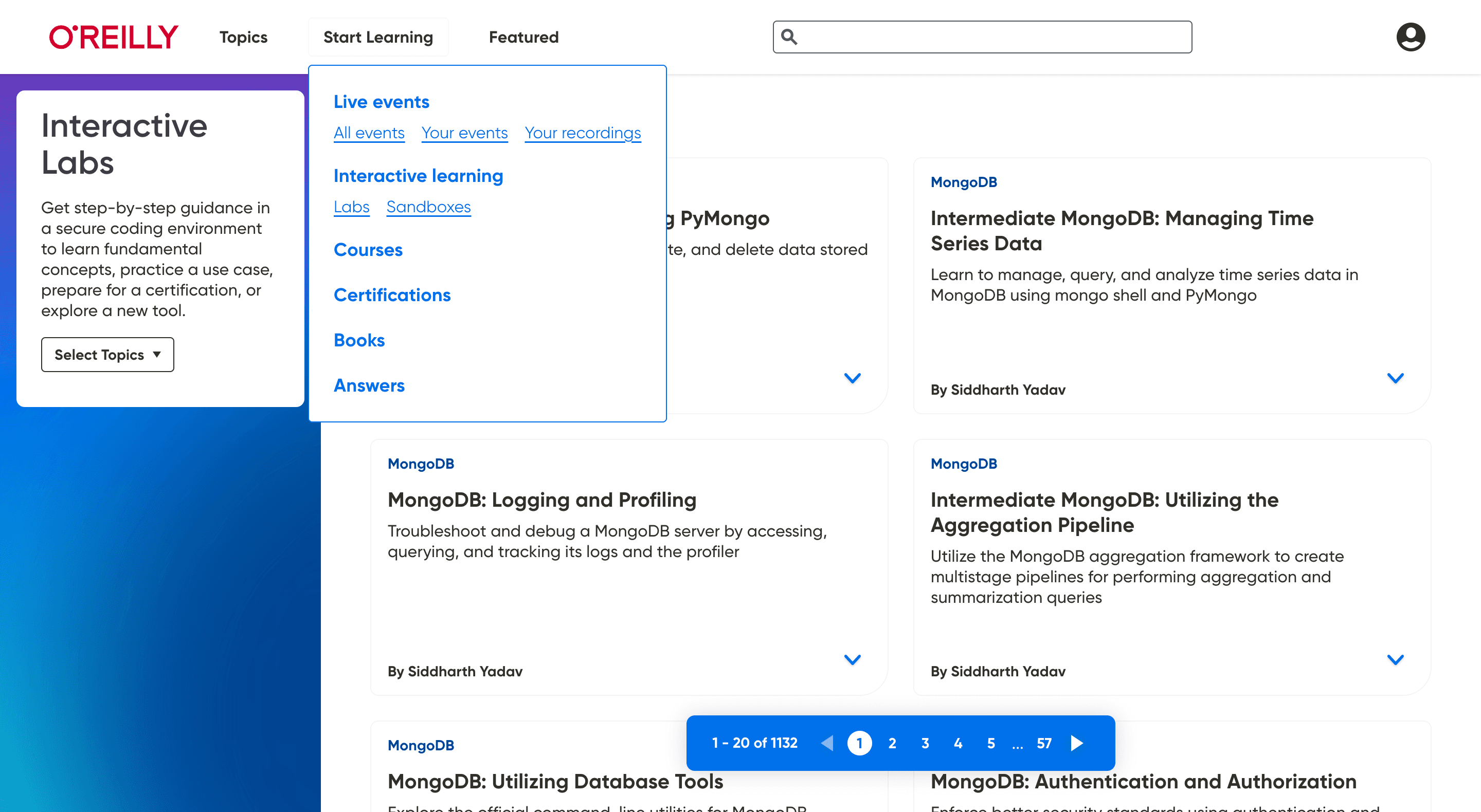

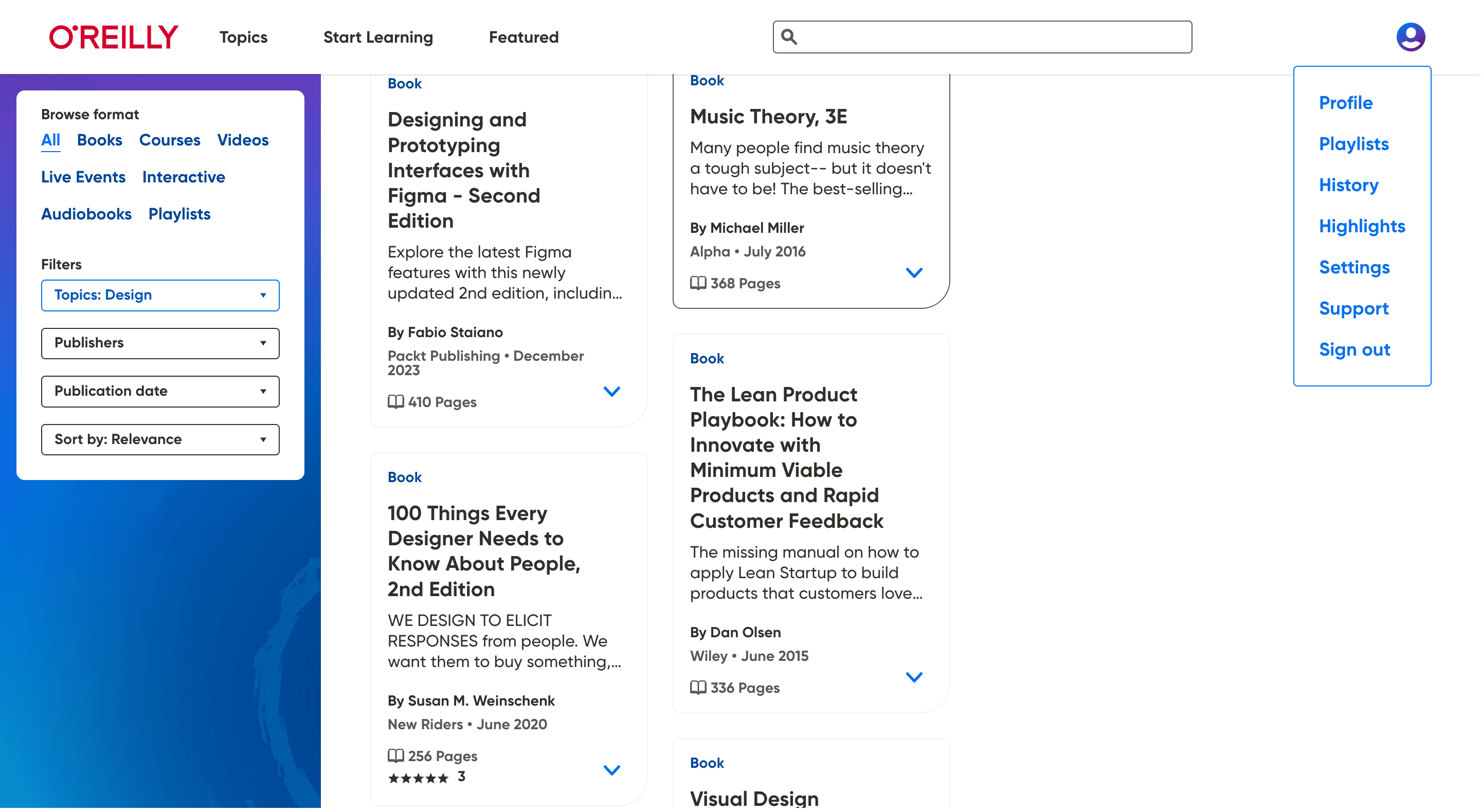

What launched

Regrettably, I departed from O'Reilly during the development of these features. Nevertheless, the work was released to the public sometime in 2023 in the following state.

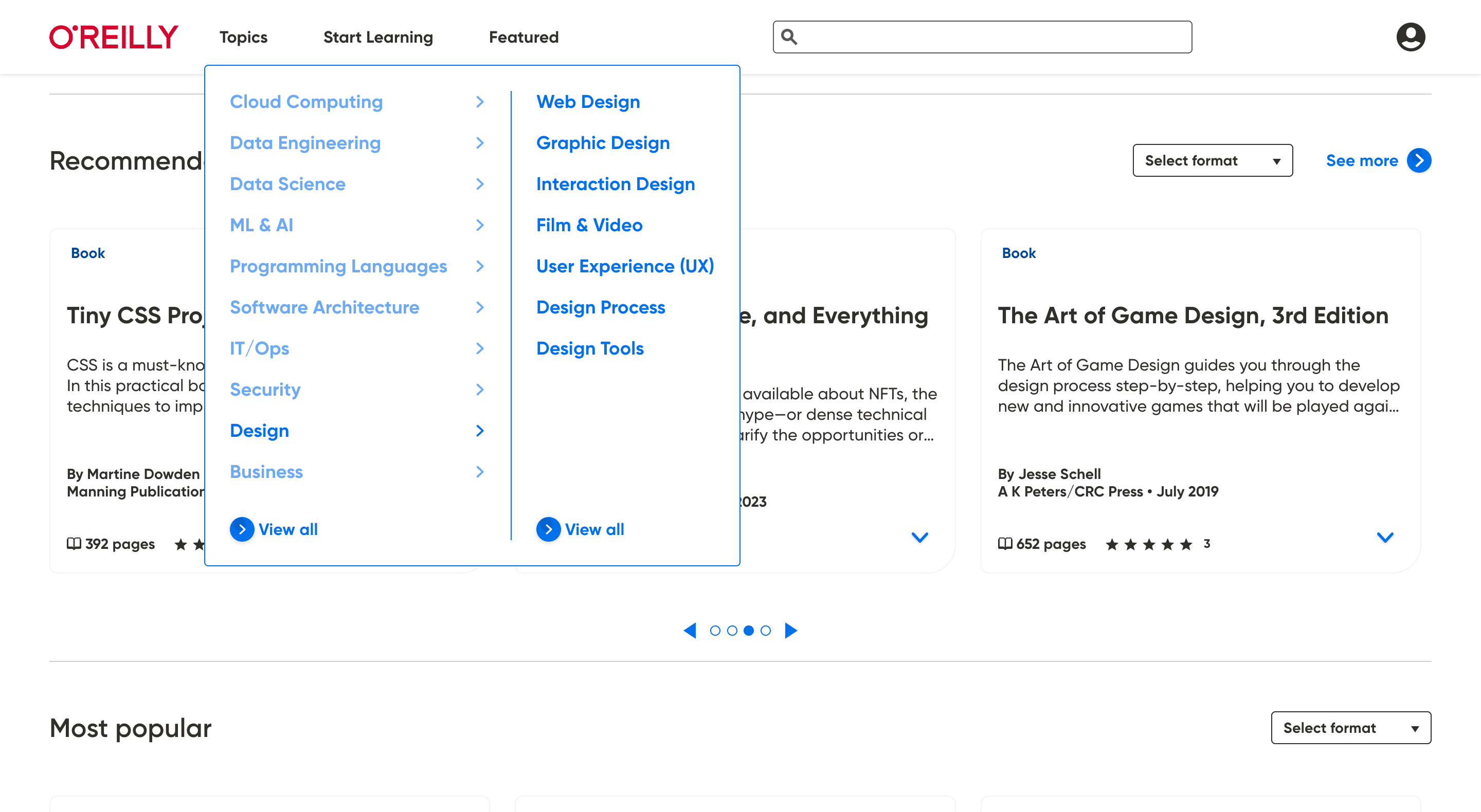

Learner-first, not content-first

Browsing is now focused on the topics and information users are interested in versus all the different methods by which they can consume content.

Striking a balance

For users that are "exploratory seeking", surfacing the core competencies of the platform enables users to easily discover the different learning options available.

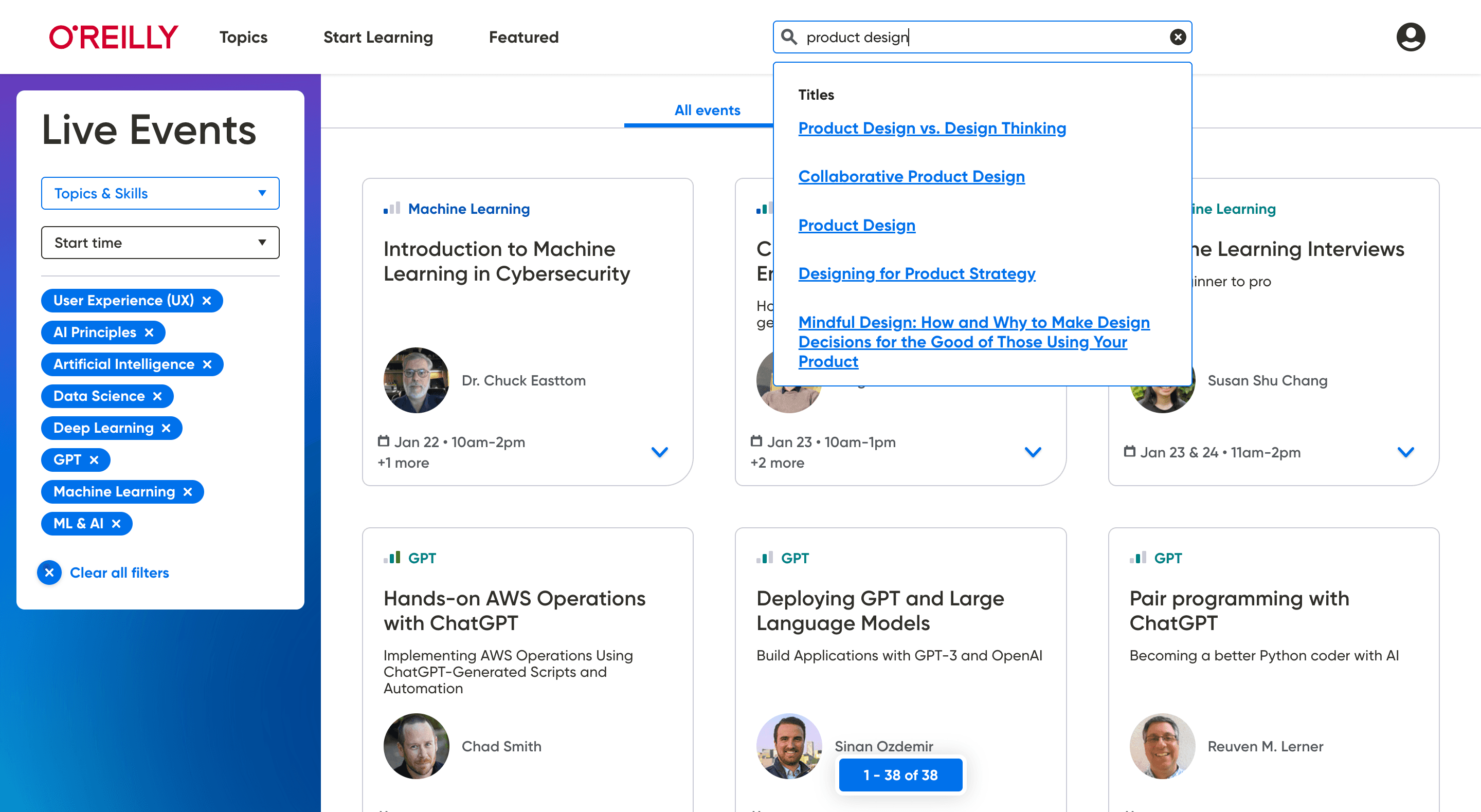

Global search

While mostly the same functionality, users can now search from any page in the app, and type-ahead results include top hits from related topics & authors.

Uniform browsing

Common links like "Sign Out" are now in their expected location on the page and the user profile menu no longer changes location when using the Reader interface.

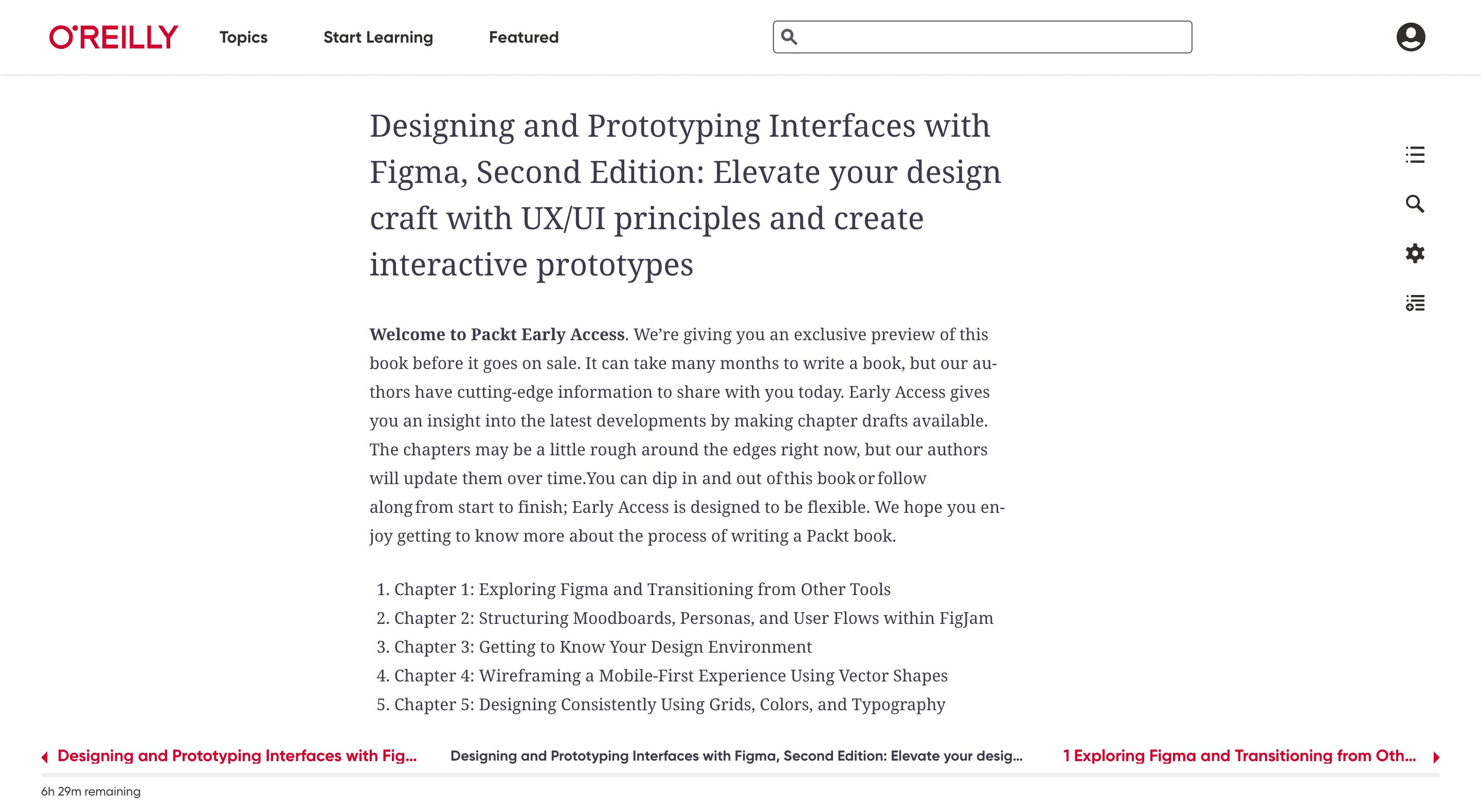

Seamless viewing

The existing nav on the Reader UI was relocated to the bottom, creating space for the new global nav and enhancing the viewing experience with a more clutter-free design.

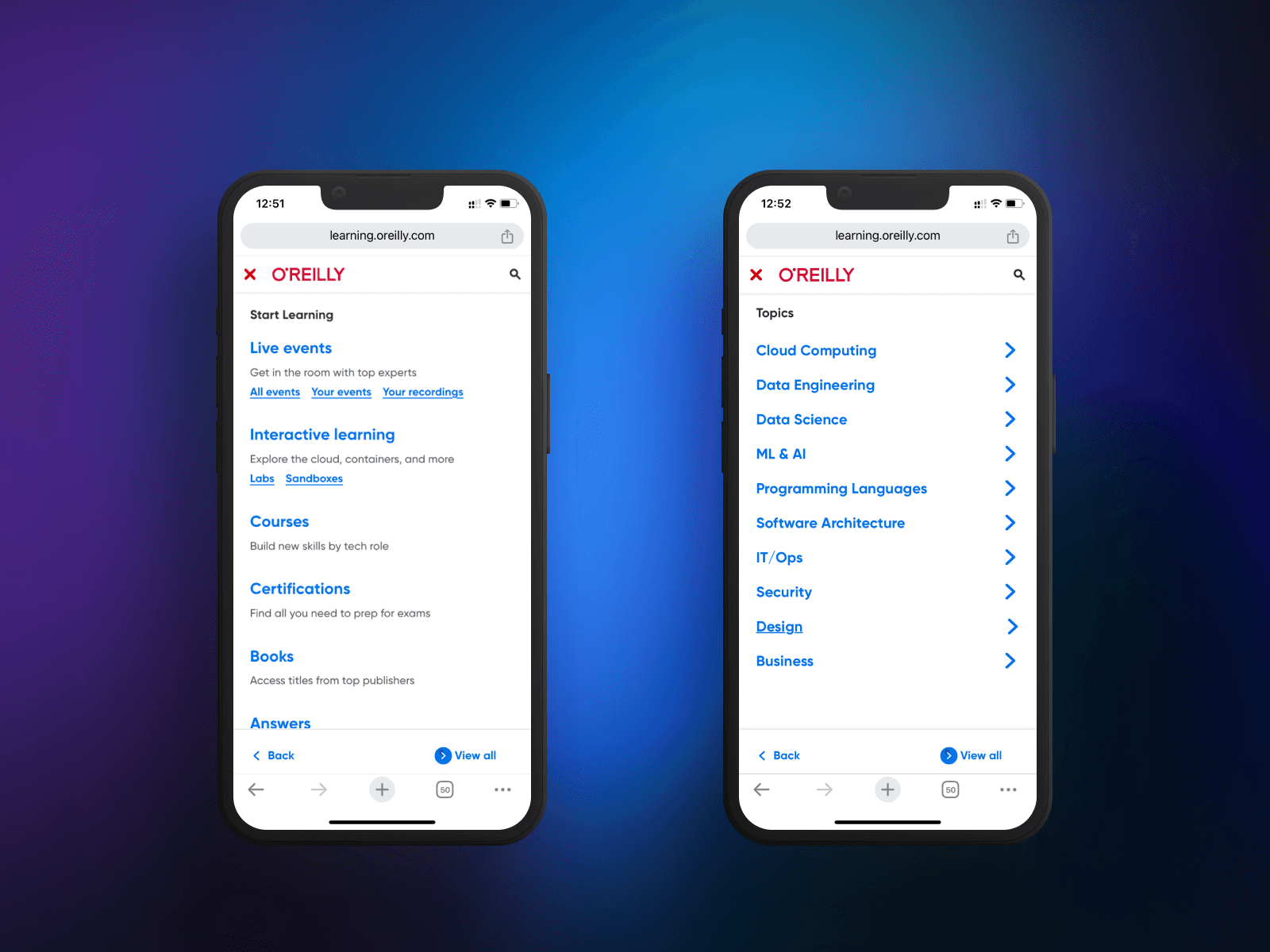

Mobile ready

Desktop layouts were translated to mobile-friendly versions that feature bottom-positioned Back and More links to reduce thumb travel.

A popular study by Smashing Magazine shows that sticky navs are 22% faster and more favored by users.

We switched to a top navigation bar to reduce cognitive overload from the cluttered left column and inconsistent collapsing sidebar. Consolidating to a single top nav created a cleaner look with fewer starting paths and more targeted entry points.

Projected Outcomes

Though I wasn't at O'Reilly during or after the release of these features, I projected the following outcomes as part of the strategic planning effort for this launch.